Did Labour Just Declare War on Aspiration?

Off the back of the UK Autumn Budget 2025, I can't help but wonder whether Labour's strategy equates to war on aspiration.

So, the circus has left town. Chancellor Rachel Reeves has sat down, the OBR has finished leaking its own documents like a sieve, and the dust is settling on the Autumn Budget 2025.

If you listen to the government front bench, today was about ‘tough choices’ and ‘broad shoulders’. If you are a working person in Britain today — someone who actually clocks in, pays their PAYE, and commits the cardinal sin of trying to save a few quid for the future — you know exactly what today was.

It was a mugging.

But it wasn’t an honest mugging. A highwayman at least has the decency to point a flintlock at you and demand your money. This Government prefers the cowardly approach: pickpocketing you while distracting you with shiny objects, hoping you won’t notice your wallet is lighter until April 2026.

They promised, repeatedly, not to raise taxes on ‘working people’. Today proved that phrase is meaningless in the mouth of the modern Labour party.

The Cowardice of Fiscal Drag

The centrepiece of this betrayal is the weaponisation of ‘fiscal drag’. It sounds technical, boring even. It is meant to. It is the preferred weapon of a Chancellor who lacks the political spine to look down the camera lens and tell you your income tax rate is going up.

By extending the freeze on Income Tax and National Insurance thresholds until April 2031 — an eternity in economic terms — Reeves has guaranteed that every time you get a pay rise just to keep your head above the drowning waters of inflation, the state will snatch a bigger percentage.

It is a tax on progress. It is a tax on getting a promotion. It drags low earners into tax for the first time and smashes middle earners into the higher 40% bracket — a bracket never designed for police officers, teachers, or mid-level managers. They are letting inflation do their dirty work, bleeding the working population dry slowly so they don’t scream too loud.

The Tax on Simple Pleasures

And because they cannot help themselves, the Nanny State has tightened its grip to bleed you further. A new ‘Milkshake Tax’ on coffee shop drinks and a drastic hike in duty on online bingo confirms that no pleasure is too small to escape the Treasury’s claws.

To this government, a working man having a canned latte and a £5 flutter on his phone is a ‘sin’ that must be taxed, while the pursuits of the metropolitan elite remain strangely unburdened. It is the puritanism of the public sector middle manager, aiming to price the working class out of their own downtime.

The Pension Ambush

If fiscal drag is the mugging you don’t see, the attack on pension relief is the one you were explicitly told wouldn’t happen. Tucked away in the small print is a new £2,000 cap on National Insurance relief for salary sacrifice contributions, kicking in from 2029.

This is a laser-guided missile aimed squarely at the aspiring middle class. These aren’t tycoons stashing millions offshore; they are prudent workers using government-approved schemes to build a pot that ensures they won’t be a burden on the state in old age. Their reward for this self-sufficiency? A tax grab that punishes you for planning ahead. It is the politics of the playground bully: if you have saved your lunch money, Labour is coming to take it.

The Attack on Responsible Business

Nothing exposes the hypocrisy of this Chancellor more than the quiet raid on Employee Ownership Trusts. For years, Labour preached that business owners should share wealth with their workers. The ‘Employee Ownership Trust’ was the vehicle for this — allowing you to sell your company to your staff tax-free.

Today, that ladder was kicked away. The relief has been slashed from 100% to 50% overnight. The message is brutal: it doesn’t matter if you try to do the ‘ethical’ thing and hand your business to your workforce. You are an asset owner, and in the eyes of this administration, that makes you a target.

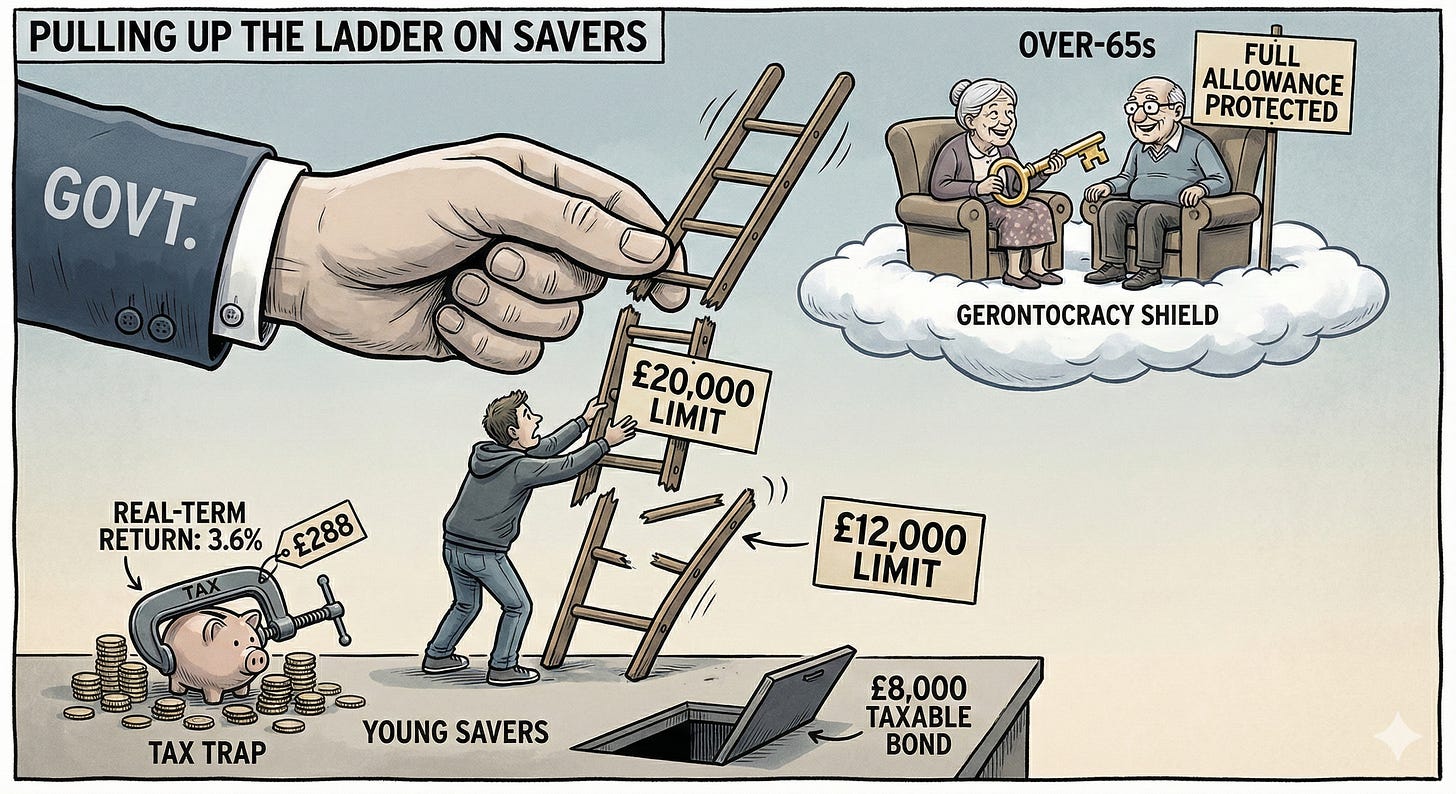

Pulling Up the Ladder on Savers

Perhaps the most spiteful nuance in this budget, the one that truly reveals the soul of this administration, is the attack on savers. The Cash ISA limit has been slashed from £20,000 to £12,000.

Let’s look at the cold, hard maths of this betrayal. Imagine you have done exactly what you were told to do: you’ve scraped together £20,000 in savings and you are ready to lock it away for a year.

Under the old rules, you could place every penny of that into a one-year cash ISA. At a top rate of 4.28%, you would walk away with £856 in interest. Pure, tax-free profit.

But under Reeves’ new rules, the portcullis comes down at £12,000. Your tax-free return on that portion drops instantly to £513.60.

So, what do you do with the remaining £8,000? You might spot a one-year bond offering a headline rate of 4.5% — higher than the ISA — and think you have outsmarted the system. Do not be fooled. This is the trap.

That ‘higher’ rate is a mirage. Once you factor in the tax you are now forced to pay, that 4.5% creates a real-term return of just 3.6%, leaving you with a measly £288.

The result? You saved the same money. You took the same risk. But because the Chancellor decided you had ‘broad shoulders’, the state has quietly reached into your pocket and skimmed the difference. It is a penalty on prudence, plain and simple.

But wait for the caveat — the exquisite, cynical caveat: Over-65s retain the full allowance.

Look at that policy and tell me this isn’t a gerontocracy. If you are a young worker, desperately trying to save a deposit for houses that boomers have watched appreciate by 500%, the government has just made it harder for you to build a tax-free safety net.

But if you are already retired, sitting on housing equity, your savings shelter is protected. Some are calling it generational warfare disguised as fiscal prudence. I wouldn’t go so far, personally, but the view of many is that sends a clear message to the working-age population: your role is to generate tax revenue, not wealth for yourself.

The Fuel Duty Time Bomb

Even where they claim to have been merciful, there is a dagger hidden in the cloak. Reeves will undoubtedly brag that she has ‘protected’ commuters by freezing regulated rail fares and maintaining the fuel duty cut. Do not fall for it.

The rail announcement is a masterclass in spin. Yes, they have frozen ‘regulated’ fares, but this covers less than half of all tickets sold. The operators remain free to hike unregulated fares to recoup their costs, meaning the occasional traveller will likely subsidise the daily commuter. And let us not be grateful for a freeze on prices that are already extortionate; freezing a £6,000 season ticket is not a gift, it is simply a pause in the beating.

Meanwhile, for drivers, she has merely set a timer on the bomb. The small print reveals that the 5p fuel duty cut will be reversed starting in September 2026, with inflation-linked rises locked in from April 2027. She knows that hiking petrol prices today would be political suicide, so she has legislated for your commute to get more expensive exactly when this government hopes to be preparing for its next election campaign. It is a cynical gamble that you will forget who lit the fuse by the time it blows up in your face.

The Green Hypocrisy

Then we have the incoherent mess of their environmental policy. They want us to go green. Fine. Many people did the ‘right thing’ and bought Electric Vehicles. The reward? A new 3p per mile tax on EVs.

And do not mistake this for a simple revenue raiser; it is the infrastructure of a surveillance state. To levy a ‘pay-per-mile’ tax, the government must know exactly how far you drive. The road to Net Zero is apparently paved with GPS trackers.

Meanwhile, the mask of the ‘caring party’ slipped further with the spiteful ban on ‘luxury’ brands from the Motability scheme. It doesn’t save meaningful cash; it is pure performance art for the politics of envy. The message is clear: even if you are disabled, you must not be seen to have nice things. Aspiration is offensive to them, even in the face of adversity.

They lure you in with subsidies and then hammer you once you’re captive. It turns the daily commute into yet another revenue stream for the Treasury.

Yet, simultaneously, Reeves announced the scrapping of the Energy Company Obligation (ECO) insulation scheme. She traded a long-term, structural solution to fuel poverty — actually insulating Britain’s drafty housing stock — for a paltry, one-off £150 bribe on energy bills. It is short-termism breathtaking in its cynicism. It buys a headline today but leaves working families freezing tomorrow.

The Great Welfare Betrayal

While they tighten the screws on the grafter, they have thrown the floodgates open for the state-dependent. The headline was the ‘compassionate’ scrapping of the two-child benefit cap. The reality is a statistical obscenity.

Buried in the impact assessments is the fact that around 18,000 households are now set to receive an extra £14,000 a year in benefits. Let that sink in. A working family would need to earn a pre-tax salary of nearly £20,000 just to match the handout that these households are getting for doing absolutely nothing other than having large families they cannot support.

We are now in a perverse reality where the state is actively incentivising dependency while punishing independence. Why would you take that promotion, or work that overtime, when the government will simply confiscate your earnings to hand £14,000 checks to those who have never clocked in? It isn’t a safety net anymore; it’s a hammock, spun from the fibres of your pay packet.

The ‘Broad Shoulders’ Lie

They will point to the ‘Mansion Tax’ surcharge on £2m+ properties and claim the rich are paying their share. It’s theatre. It’s bread and circuses to distract from the reality that the real money isn’t in the few mansions in Kensington ; it’s in the millions of pay packets of the squeezed middle.

Even the rise in the minimum wage, welcome as it is for the lowest paid, is a mirage. What the government gives with one hand, their extended threshold freezes and inflation will claw back with the other.

The Grim Reality of 38p

The OBR has confirmed the final tally of this raid. By 2030, the tax burden will hit 38.3% of GDP. That means for every single pound earned in this country, the state takes nearly 38 pence. It is the highest level of taxation in seventy years. We are being taxed like a nation at war, but the only enemy this government seems to be fighting is the concept of private wealth.

Today’s Budget confirms a grim reality for the British worker. You are the cash cow. You are squeezed between a state that demands more of your income to fund public services that seem to get worse, and an economy rigged to protect assets over earnings.

Aspiration is dead. Prudence is punished. Welcome to the depressing reality of Britain in 2025.